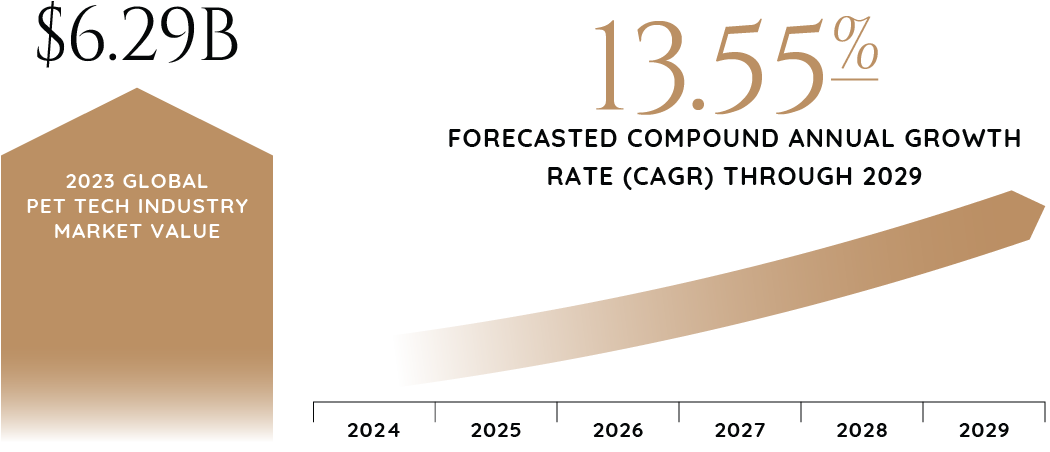

The global pet tech industry was valued at $6.29 billion in 2023 and is forecast to flourish at a compound annual growth rate (CAGR) of 13.55% through 2029. One significant trend impacting the pet tech market is the humanization of pets. More than ever, pet owners want to give their animals experiences and goods corresponding to the caliber of care they would provide themselves. As pet owners prioritize their animal companions' comfort, happiness, and health, high-end pet tech products such as smart toys, advanced health-monitoring devices, and personalized nutrition solutions are being developed.

Market Segmentation by Type

• RFID

• GPS

• Sensors

• Other

Market Segmentation by Product

• Monitoring Equipment

• Tracking Equipment

• Feeding Equipment

• Wearables

• Other

Market Segmentation by Application

• Pet Safety

• Pet Healthcare

• Pet Owner Convenience

• Communication and Entertainment

Segmentation Insights

The monitoring equipment segment dominated the global pet technology market last year. Health monitoring devices make up a significant portion of the Monitoring Equipment segment. Wearables such as intelligent collars, activity trackers, and health sensors are designed to monitor a pet's vital signs, activity levels, and overall health. Advanced sensors in these devices can monitor parameters such as heart rate, respiratory rate, sleep patterns, and calorie burn. The collected data is frequently sent to a specialized mobile app or online platform, allowing pet owners and veterinarians to track and analyze trends over time.

GPS tracking systems are essential components of monitoring equipment. They provide pet owners with peace of mind by allowing them to track their pets' locations in real time. GPS-enabled collars or devices provide precise location data, and some even include geo-fencing features that send alerts when a pet leaves a specific area. This technology addresses concerns about lost or stolen pets and improves pet safety, particularly for those who lead outdoor or adventurous lifestyles.

This monitoring equipment focuses on the pet's environment, ensuring the best conditions for their wellbeing. Smart pet cameras with temperature and humidity sensors allow pet owners to monitor their pets' living conditions remotely. This is especially useful for pet owners who leave their pets at home during the day, as it provides insights into environmental factors that may affect the pet's comfort and health.

Market Trends & Drivers

Growing Pet Ownership

A rise in pet ownership worldwide drives strong growth in the pet technology market. The way that society views pets has changed significantly in recent years. More people now view their pets as essential members of the family. Due to this shifting viewpoint, there is an increasing need for creative solutions for pet care, propelling pet technology's advancement and uptake. There is a corresponding rise in the willingness to invest in the wellbeing of pets as more households welcome them into their lives. Pet owners seek goods and services that improve their animals' quality of life. This tendency is especially noticeable in developed economies with higher levels of disposable income.

The pet tech sector is taking advantage of this change in consumer behavior by offering products such as health monitoring devices, automated feeders, and intelligent pet trackers. One of the main forces behind this trend is the younger generation, more frequently referred to as pet parents. Generation Z and Millennials, recognized for having a strong affinity for technology, are more likely to adopt and incorporate pet technology into their daily lives. The proclivity of this demographic towards digital solutions and connected devices is driving the global pet tech market's expansion.

Ongoing Tech Innovation

The continuing evolution of technology and its rapid innovation pace are critical drivers of the growth of the global pet tech market. As technology advances and becomes more accessible, pet owners are presented with various cutting-edge solutions for different aspects of pet care. Wearable devices, intelligent pet toys, and remote monitoring systems have become increasingly popular.

Artificial intelligence (AI) and machine learning are helping to develop more imaginative pet tech solutions. For example, AI-powered pet trackers can analyze data regarding a pet's activity levels and health metrics, providing valuable insights to pet owners and veterinarians. Furthermore, the IoT (Internet of Things) allows for real-time monitoring and communication, allowing pet owners to stay in touch with their pets even when they are away from home.

The ongoing cycle of tech advancements not only improves the functionality of existing pet tech products but also inspires the development of new and innovative solutions. Pet tech companies invest heavily in R&D to stay ahead of the curve, ensuring that their products meet pet owners' ever-changing needs and expectations.

Increasing Awareness of Pet Health and Wellbeing

Another significant factor driving the global pet tech market's growth is increased awareness of pet health and wellbeing. Pet owners are becoming more concerned about their animals' physical and mental health, resulting in a surge in demand for products that enable proactive and preventative care. Pet health monitoring devices, such as intelligent collars and wearable sensors, are becoming increasingly popular because they allow owners to track vital signs, activity levels, and potential health issues in real-time. These technologies enable pet owners to take a more proactive approach to managing their pets' health, allowing for early detection of illnesses and prompt intervention.

The growing emphasis on preventative care for pets drives demand for innovative nutrition solutions. Pet food technologies, such as personalized nutrition plans and automated feeders, are intended to meet the unique dietary needs of individual pets. This focus on tailored nutrition is consistent with the more significant trend of humanizing pets, in which pet owners strive to provide the best possible care and food for their animal companions. Rising pet ownership trends, ongoing technological advancements, and increased awareness of pet health are driving the global pet tech market forward. As the bond between humans and their pets strengthens, the demand for innovative and technologically advanced pet care solutions will remain vital.

By Region

North America emerged as the dominant region in 2023, with the highest market share. The area has been at the forefront of technological innovation, and this trend continues in the pet tech market. The region is home to several startups and established businesses constantly pushing the boundaries of what is possible within pet care technology.

North American consumers are early adopters of cutting-edge pet technology products, including intelligent pet wearables and advanced pet monitoring systems. This culture of innovation is backed up by a robust ecosystem of investors, accelerators, and research institutions dedicated to advancing pet technology.

North America also has a well-established regulatory environment for pet products, ensuring the safety and efficacy of pet technology solutions. Compliance with regulatory standards is critical for market players seeking consumer trust and navigating the complex landscape of regional and national regulations. The presence of regulatory frameworks promotes the development of high-quality and dependable pet technology products on the market.

M&A

More consumers are seeking high-quality products and services for their pets, so companies are seeking ways to deliver on those demands while differentiating themselves from their competition. M&A is a key strategy to achieve such diversification and differentiation.

The pet tech space has also become more consolidated in many subsectors. This includes veterinary and health, as many private equity and large strategic investors are turning to M&A strategies to scale up. More consolidation makes the industry more competitive, which leads to more M&A deals.

Private equity buyers are very active in the pet tech space, accounting for a large portion of deal activity, and financial buyers are also very interested in the sector because it has demonstrated a certain level of recession-proof.

Deal activity is expected to continue robustly in the pet tech industry, drawing premium transaction multiples as more sellers capitalize on the hot market and new private equity buyers seek to add to their platforms.

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.

Verwandte Artikel

Benchmark International Announces Tyrus O’Neill as New Chief Executive Officer (CEO) of the AmericasTAMPA, FL – 03/14/2025 – Benchmark International, a leading global mergers and acquisitions (M&A) advisory firm, is excited to announce Tyrus O’Neill as the new Chief Executive Officer (CEO) of the Americas. The appointment is part of Benchmark International’s ongoing strategy to accelerate its global growth and service innovation.Erwartungen für Fusionen und Übernahmen im mittleren Marktsegment im Jahr 2025Jüngste Umfragen haben gezeigt, dass die M&A-Aussichten für das Jahr 2025 den größten Optimismus der letzten Jahre in Bezug auf Geschäftsabschlüsse erkennen lassen. Die 14. jährliche Umfrage der Citizens Bank unter mehr als 400 Führungskräften des Mittelstands und Private-Equity-Investoren in den Vereinigten Staaten ergab, dass ein günstiges wirtschaftliches Umfeld ein Hauptgrund dafür ist, dass Unternehmen und Investoren im Jahr 2025 nach M&A-Strategien suchen werden. Außerdem haben sich die Unsicherheiten der letzten Jahre gelegt, und die Bewertungen werden als stabil oder höher als in den vergangenen Jahren eingeschätzt. Kleinere mittelständische Unternehmen gehen indes zurückhaltender vor, und viele Verkäufer entscheiden sich für den Verkauf eines Teils ihres Unternehmens und nicht für einen Komplettverkauf. Zusammenfassend lässt sich sagen, dass die befragten Entscheidungsträger für das Jahr 2025 ein Wirtschaftswachstum und eine höhere Rate an M&A-Transaktionen erwarten.