The Global Architecture, Engineering & Construction (AEC) market was valued at $10.05 billion in 2023, with a forecasted compound annual growth rate of 10.3% to reach $24.36 billion by 2032.

Despite interest rate hikes, inflation, supply chain issues, and labor challenges, construction operators have recently benefited from declining costs (such as fuel and energy). In the coming years, record public sector spending on new projects will support increased profitability, resulting in solid backlogs, increased project certainty, and improved overall industry health.

According to The American Institute of Architects (AIA) Consensus Construction Forecast Panel, the nonresidential construction sector grew by nearly 20% in 2023—a growth not seen since the construction boom before the Great Recession.

Construction executives report confidence that the sector will continue to grow and add jobs through 2024. More than 83% of respondents to Engineering News Record's (ENR) survey on confidence in the construction industry expect either a stable or improving market in 2024.

The market value of the global construction industry is forecasted to reach $13.9 trillion in 2037, with China, the U.S., and India contributing 57% of the growth by 2030.

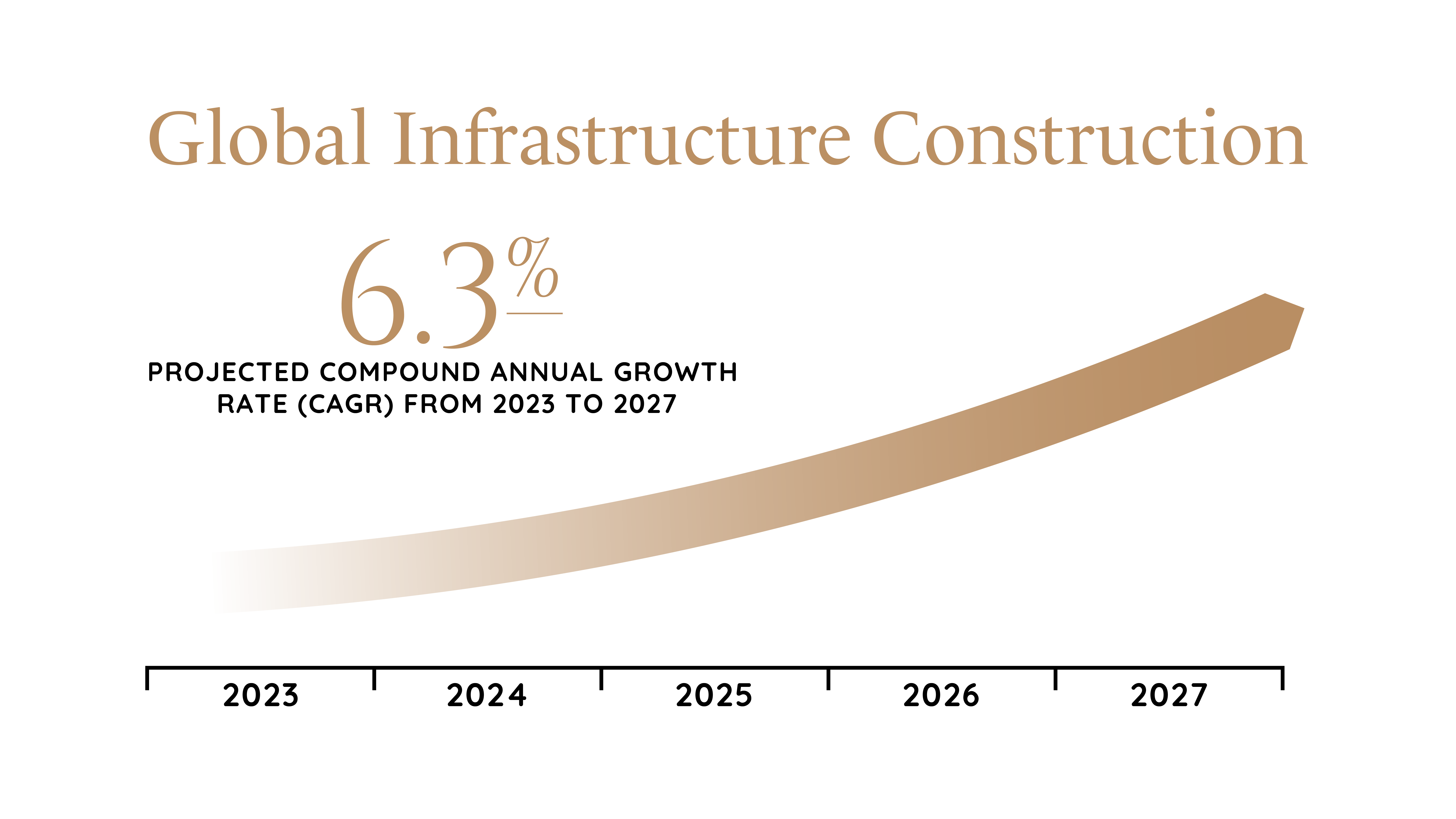

Global infrastructure construction projects to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2027. Public sector spending, especially in the U.S., Europe, and China, will drive this growth. Government initiatives expect to stabilize residential construction and reduce homelessness by 25% by 2025. Worldwide, market growth is driven by a surge in sustainable homes, comprehensive master planning, pedestrian-friendly communities, disaster-ready infrastructure, and flexible designs.

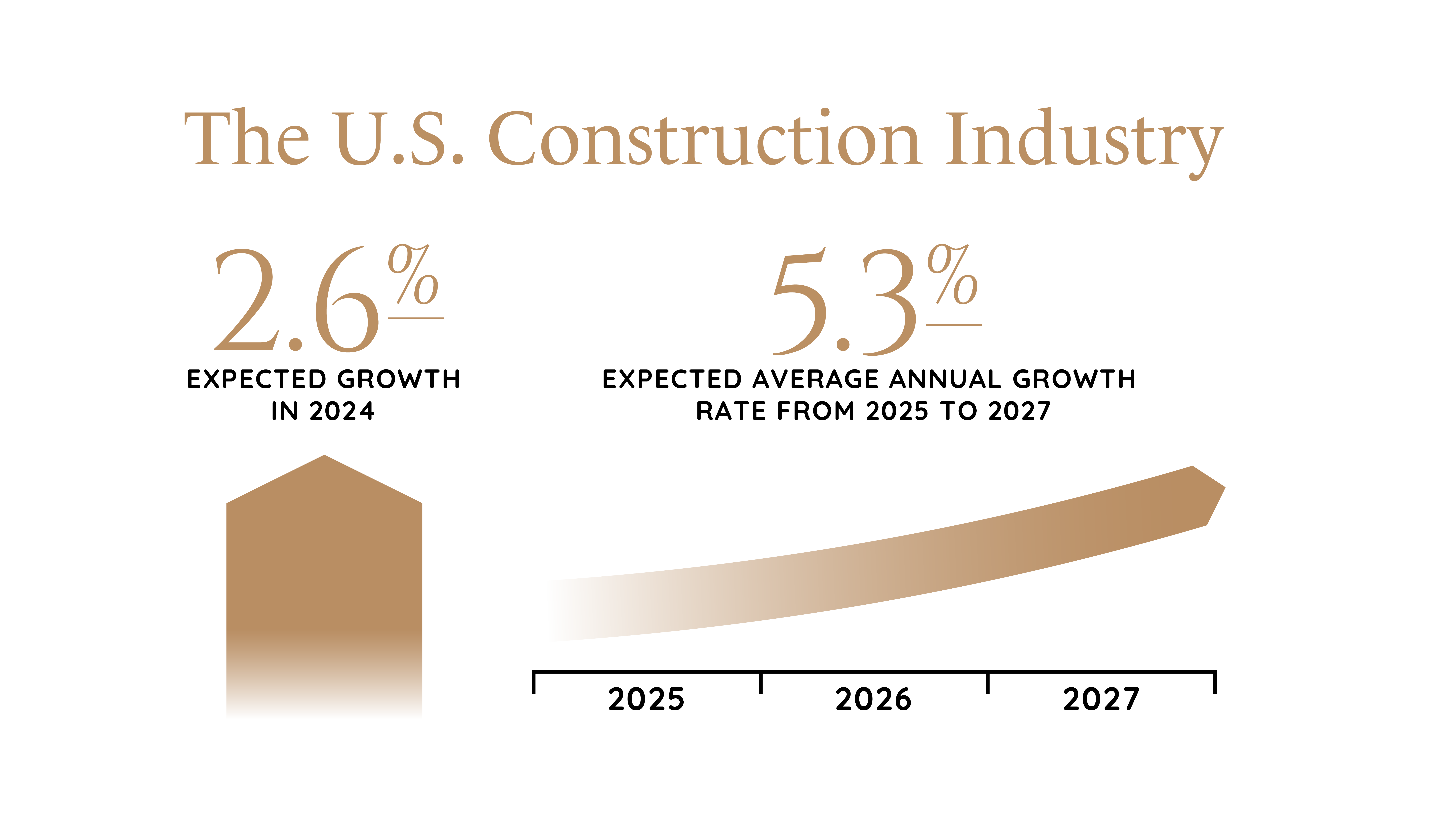

The U.S. construction industry expects to grow by 2.6% in 2024 and, on average, an annual growth rate of 5.3% from 2025 to 2027. Energy, transportation, housing, and manufacturing investments will drive this growth.

Commercial contractors continue to see high demand for projects associated with chip manufacturing, clean energy facilities, and national infrastructure.

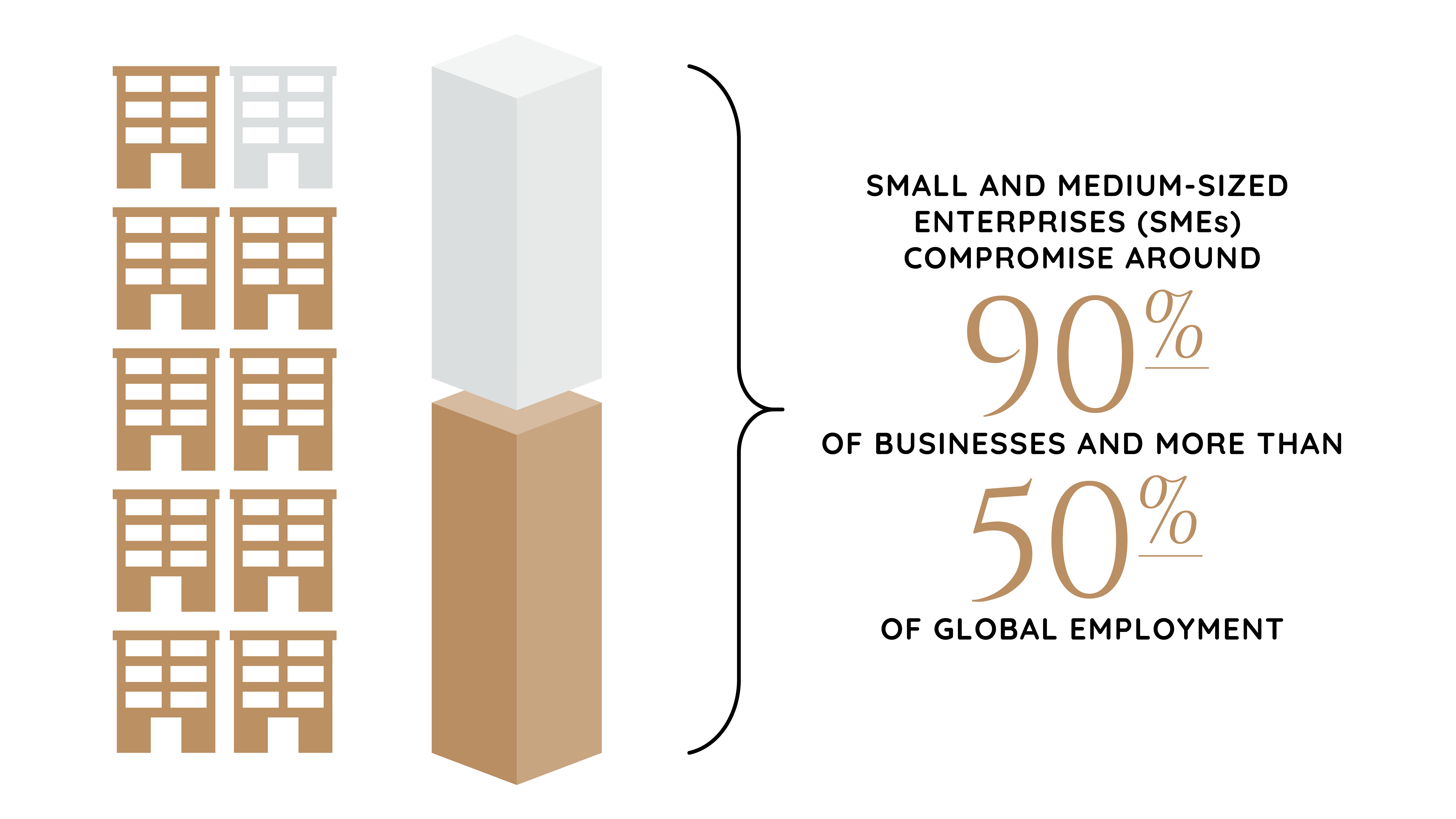

Small and medium-sized enterprises (SMEs) lead the global AEC market share, driven by growing infrastructure projects. They play a significant role in job creation and economic growth, comprising around 90% of businesses and more than 50% of global employment.

Commercial and significant construction projects is expected to grow in 2024 as more consumer spending and governmental investments go to tourism, office buildings, and retail spaces.

By 2024, the AEC industry is expected to focus on digitalization, data, AI, VR, and sustainability. Innovations like intuitive design software and earth-friendly materials are the industry's future.

With technological advancements, construction companies use data analytics to assess productivity, plan projects, predict market patterns, and accomplish other tasks. Over the next few years, more of these businesses will use data analytics to improve overall decision-making and help them remain competitive in the current market. Data analytics are used to increase building efficiency, lower environmental impacts, improve collaboration, improve quote accuracy, reduce human error, and create better timelines.

The International Energy Agency is pushing for net zero emissions by 2050. All new structures and 20% of existing buildings should be zero-carbon-ready by at least 2030. In the U.S., $2 billion in federal funds are designated for projects using low-embodied carbon construction materials such as asphalt, concrete, glass, and steel.

The construction industry faces the highest labor shortage ever recorded, which puts construction jobs and the average construction worker in high demand. Therefore, wages can also be expected to increase.

M&A

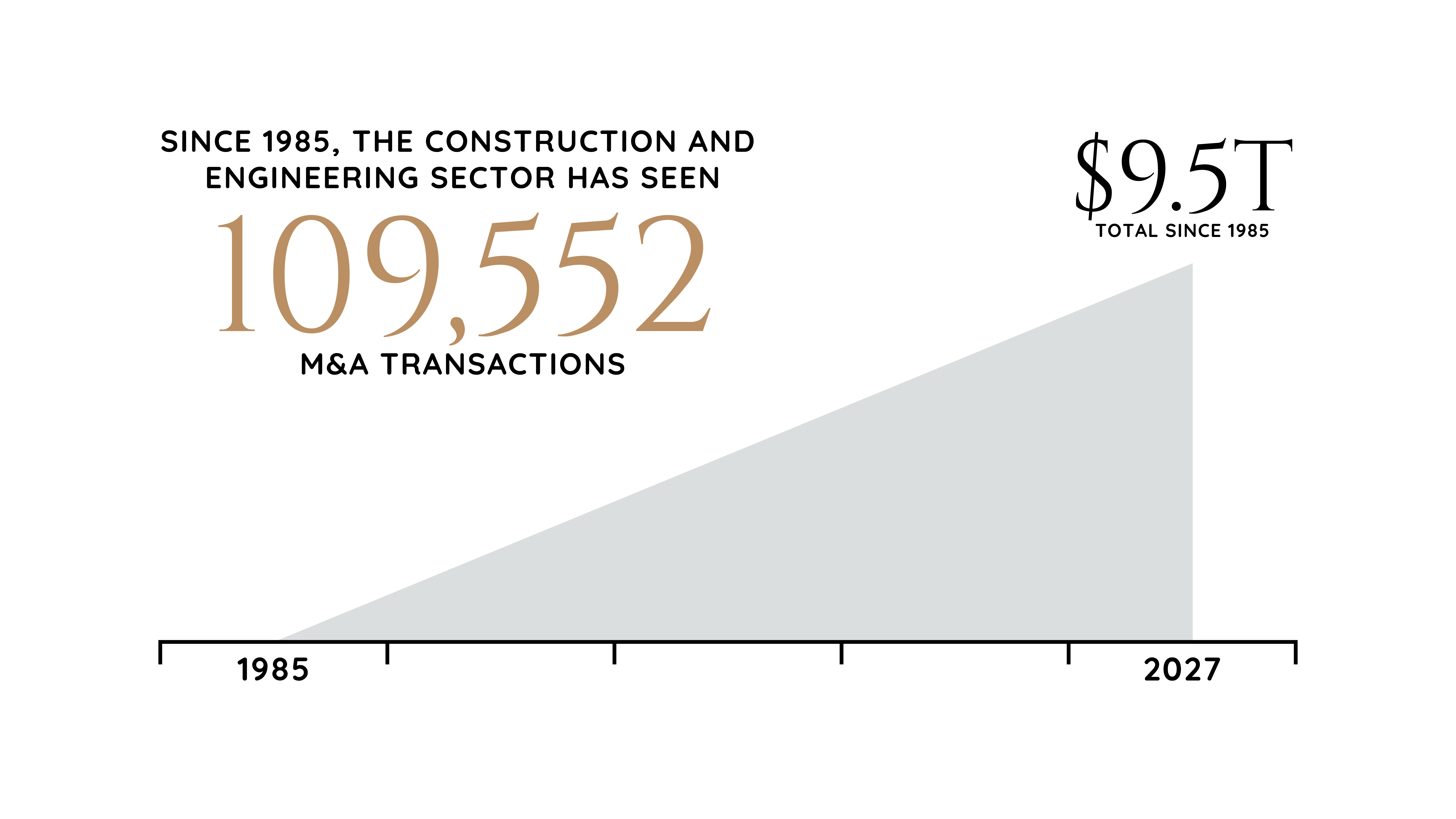

Since 1985, the construction and engineering sector has seen 109,552 M&A transactions, totaling $9.5 trillion, underscoring its substantial influence on the global economy. Following vigorous M&A activity in 2021 and 2022, deal volumes and valuations across the construction industry have proven resilient.

Federal and other legislative funding is driving business performance into the foreseeable future. This supplemented demand has led industry constituents to pursue M&A strategies, both as buyers looking to improve their market position and sellers looking to capitalize on historic tailwinds.

Construction operators looking to sell a business have a range of options, from existing family members and executives to large industry conglomerates. Industry tailwinds have led to increased M&A use to gain market share, improve market position, and establish redundancies in the supply chain through in-house manufacturing capabilities.

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.