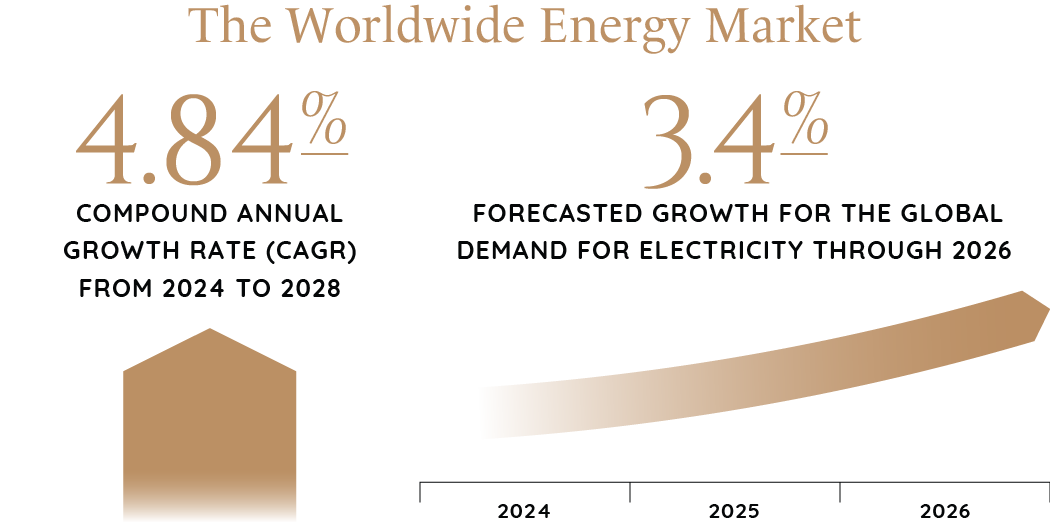

Global demand for electricity is forecast to rise faster over the next three years, growing by an average of 3.4% annually through 2026, driven by an improving economic outlook. The worldwide energy market is expected to experience a compound annual growth rate (CAGR) of 4.84% from 2024 to 2028.

Power demand is expected to increase globally due to several factors that differ by region, such as growth in emerging markets’ energy needs, electrification across the world’s economy, and rising green hydrogen demand. Over the next 20 years, the share of renewables in the global power mix could more than double.

Governments and companies are rethinking supply chains and infrastructure and investing in new technologies and adaptability measures. At the United Nations Climate Conference (COP28), 200 countries called for the transition away from fossil fuels. In the U.S., more than 100,000 new climate jobs have been created, motivated by the Inflation Reduction Act and a huge demand for power from renewables.

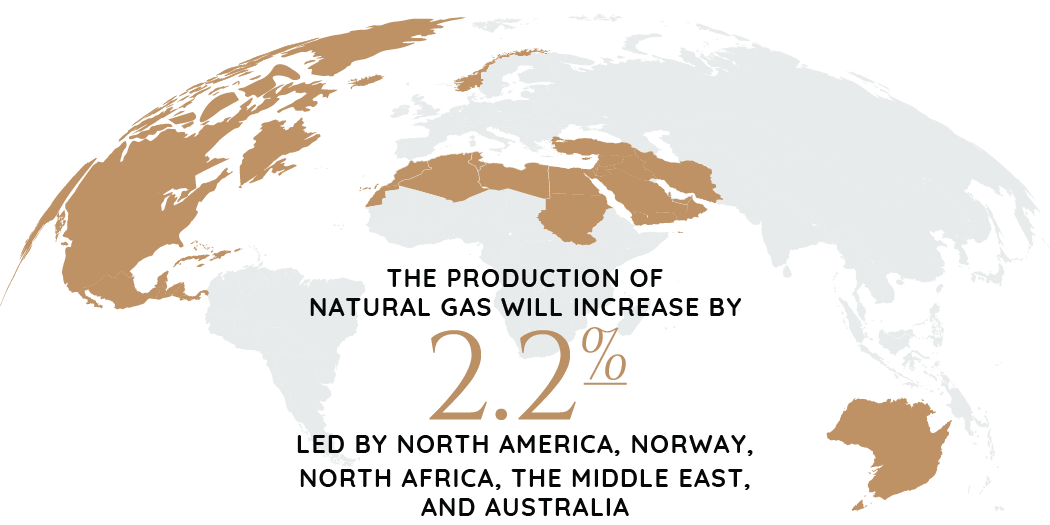

Despite such global pressure for reduced fossil fuel consumption, the demand for oil, gas, and coal will still reach a record level this year. Natural gas production will increase by 2.2%, led by North America, Norway, North Africa, the Middle East, and Australia. Oil prices will remain high as OPEC and Russia manage production levels and demand. And, even though coal consumption has sharply declined in most advanced economies, demand in developing economies remains strong, led by India, China, and Indonesia. This is due to rising demand for electricity and low hydropower output.

Other significant factors in the sector are that electricity consumption by data centers, artificial intelligence (AI), and the cryptocurrency sector could double by 2026, and renewables are on track to provide more than a third of total electricity globally by early 2025, overtaking coal.

Solar Energy

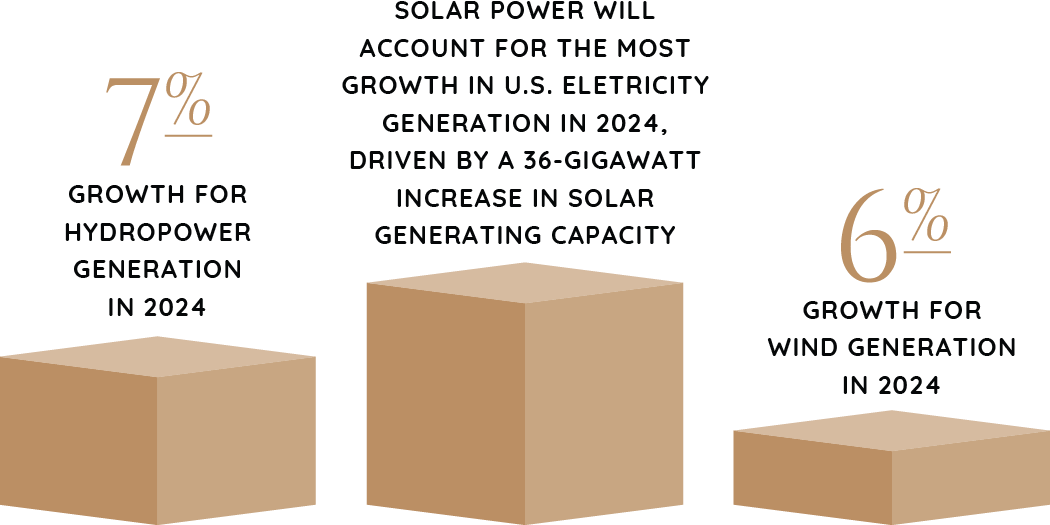

Solar power will account for the most growth in U.S. electricity generation in 2024, driven by a 36-gigawatt increase in solar generating capacity. Wind generation will grow by 6%, following a slight drop in 2023 due to lower average wind speeds, and hydropower generation will grow by 7% in 2024 due to slightly higher water supply levels.

Energy Storage

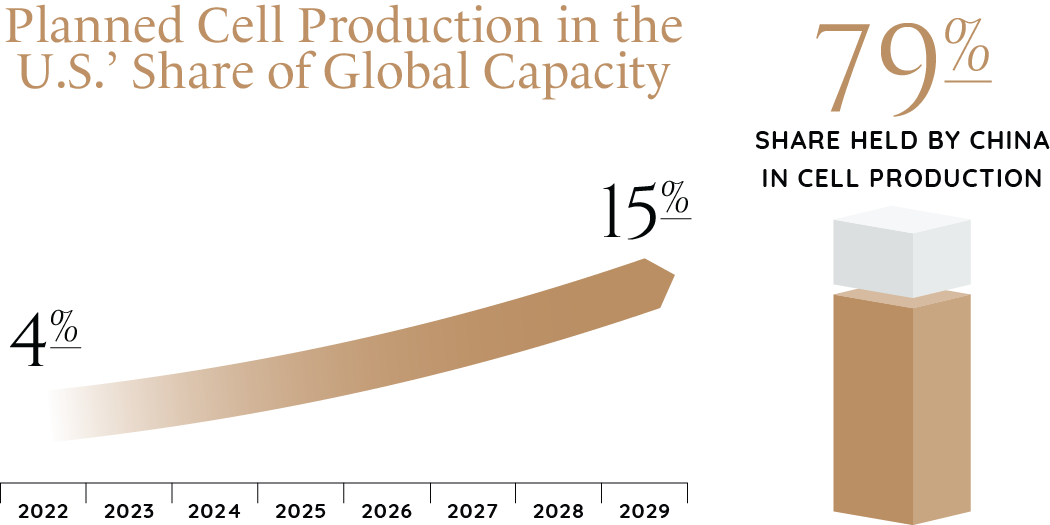

The storage sector is on a comparable track to solar. Current projects in 2024 could drive almost eight times the growth in battery manufacturing capacity. Also, planned cell production could increase the U.S.’s global capacity share from 4% in 2022 to 15% by 2029. China currently holds a whopping 79% share in this segment. Additionally, imports of lithium-ion batteries reached a record high last year. The U.S. remains entirely dependent on imports for many upstream supply-chain components.

Wind Energy

Wind energy is growing slower than solar because offshore wind production garners less investor interest due to rising costs, high-interest rates, and supply chain issues.

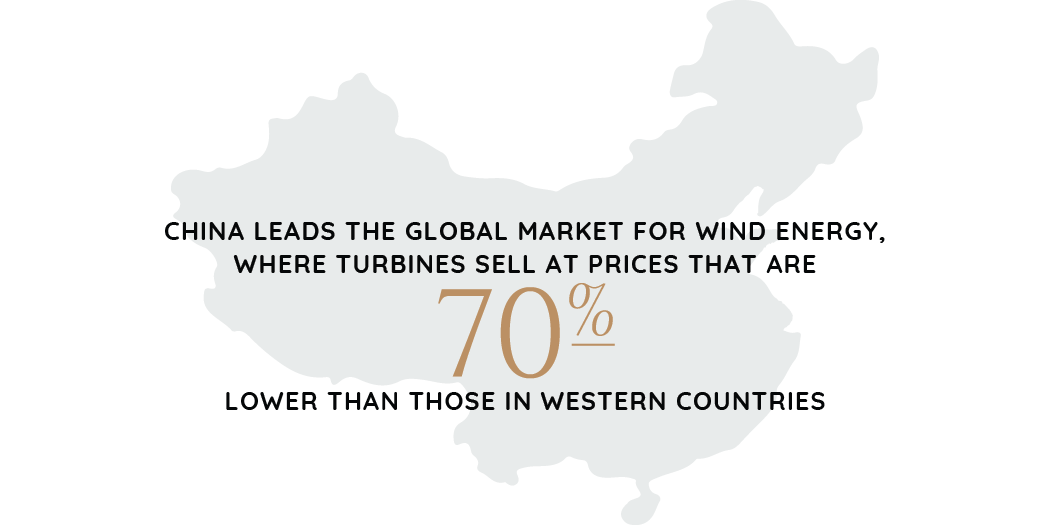

China leads the global market for wind energy. Turbines sell at prices 70% lower than those in Western countries. China’s supply chain is primarily insulated from import pressures due to solid developer relationships, specifications, and incentives in offshore wind.

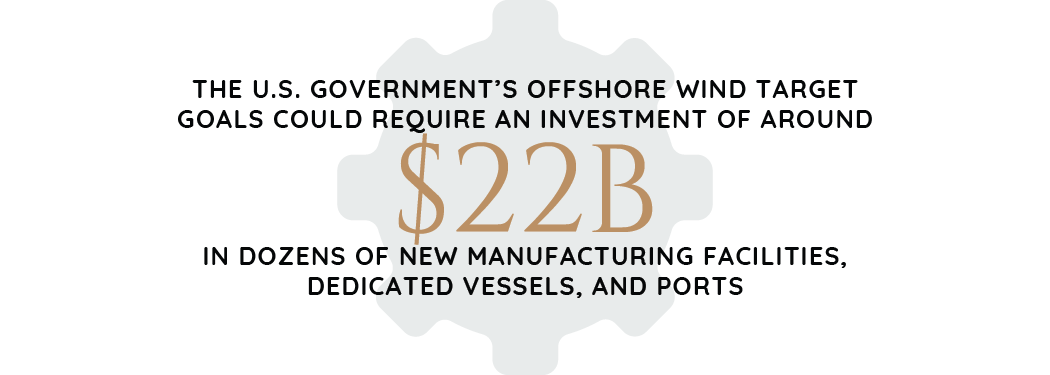

The U.S. government’s offshore wind target goals could require an investment of around $22 billion in dozens of new manufacturing facilities and several dedicated vessels and ports. Plans to develop 18 component-manufacturing facilities are currently underway, and nine East Coast states and federal agencies are expected to collaborate on offshore wind supply-chain build-outs.

M&A

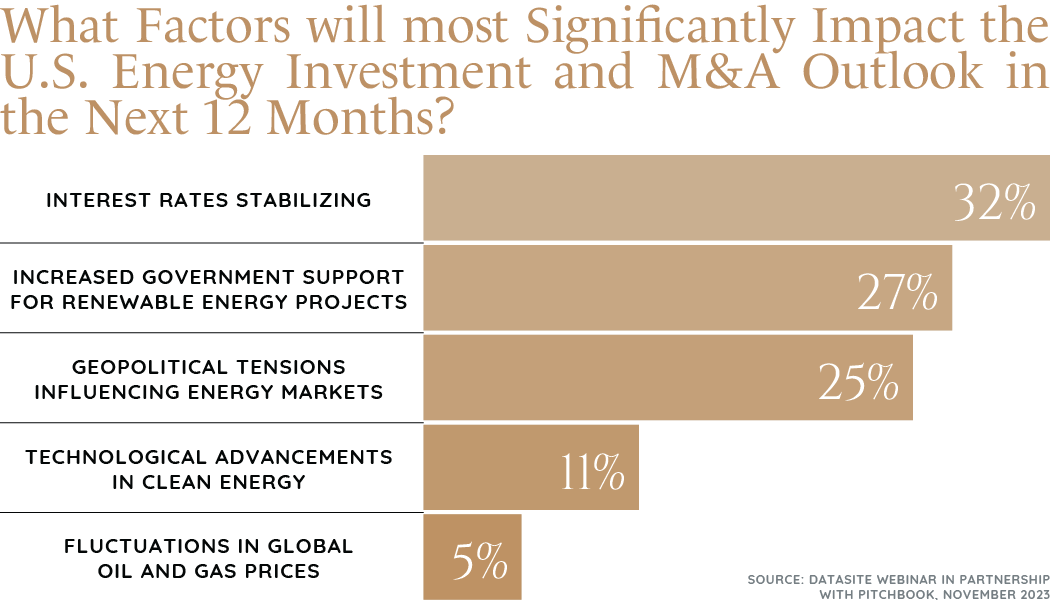

Enormous oil and gas companies are under pressure to make investments to consolidate and scale. Consolidation and divestitures are expected to be the most significant catalysts for energy M&A activity in 2024.

As the economy witnesses energy transition efforts, analysts and investors are unsure of how to value renewable power companies. This could lead to an active M&A market in 2024 and beyond, and valuation imbalances could lead to several potential takeovers this year.

Increasing demand for digitization and tech innovation is also driving M&A activity in the sector. The transition to renewable energy attracts U.S. investment in climate tech and cleantech, with billions continuing to invest in these areas.

In 2024, we can expect traditional energy companies to be net sellers of renewable energy companies. This is because many of these companies underestimated the timeframe needed to bring new technology to the market and implement new infrastructure, as the world still runs on infrastructure designed around oil and gas.

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.