The global architecture, engineering & construction (AEC) market was valued at $10.05 billion in 2023. It is forecasted to witness a compound annual growth rate (CAGR) of 10.3% to surge to $24.36 billion by 2032.

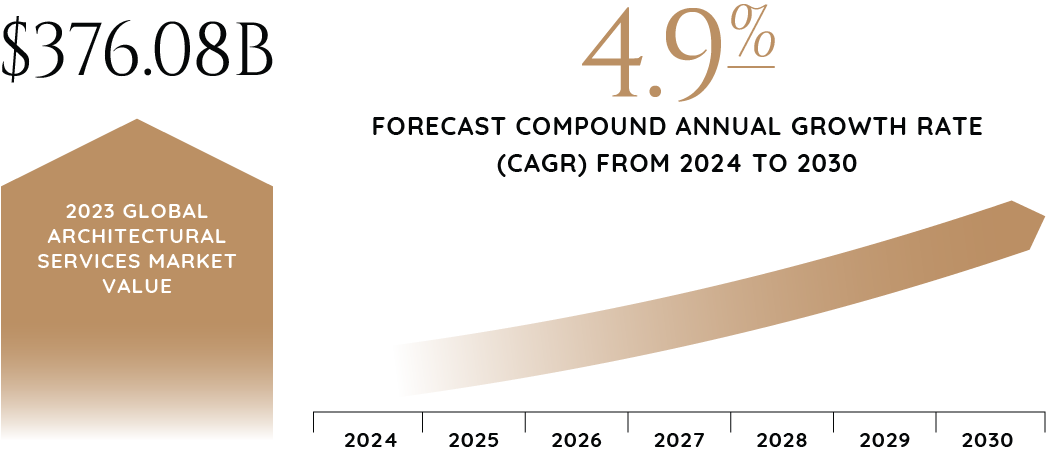

The global architectural services market value was $376.08 billion in 2023 and is forecast to grow at a CAGR of 4.9% from 2024 to 2030.

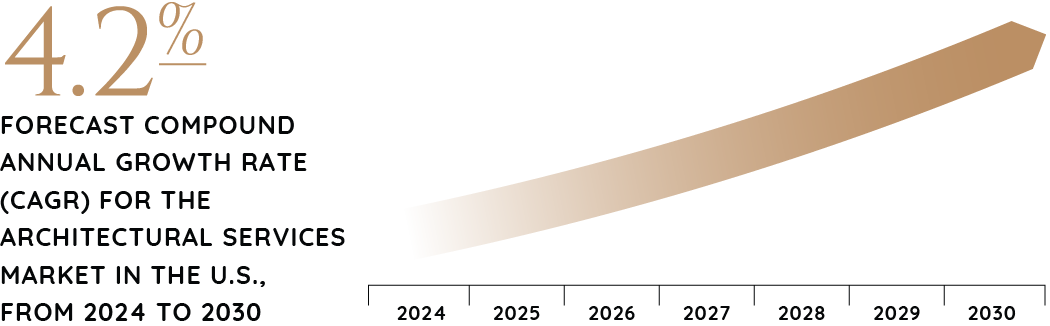

- In the U.S., the architectural services market is forecast to grow at a CAGR of 4.2% from 2024 to 2030.

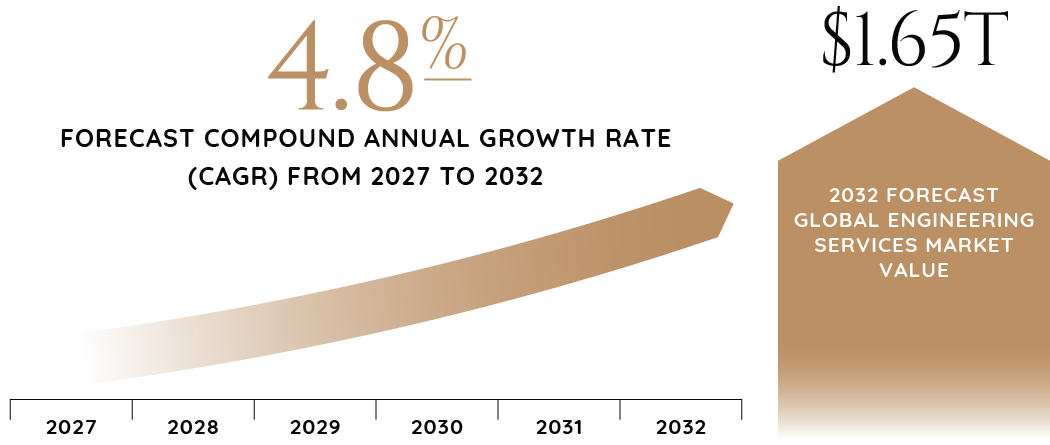

The global engineering services market is on track to grow at a CAGR of 4.8% from 2027 to reach $1.65 trillion by 2032. Partnerships and collaborations are a growing trend in the market to strengthen their competitive positions.

The global architectural, engineering consultants and related services market is expected to grow from $1.29 trillion in 2021 to $1.65 trillion in 2026 at a rate of 5.1%.

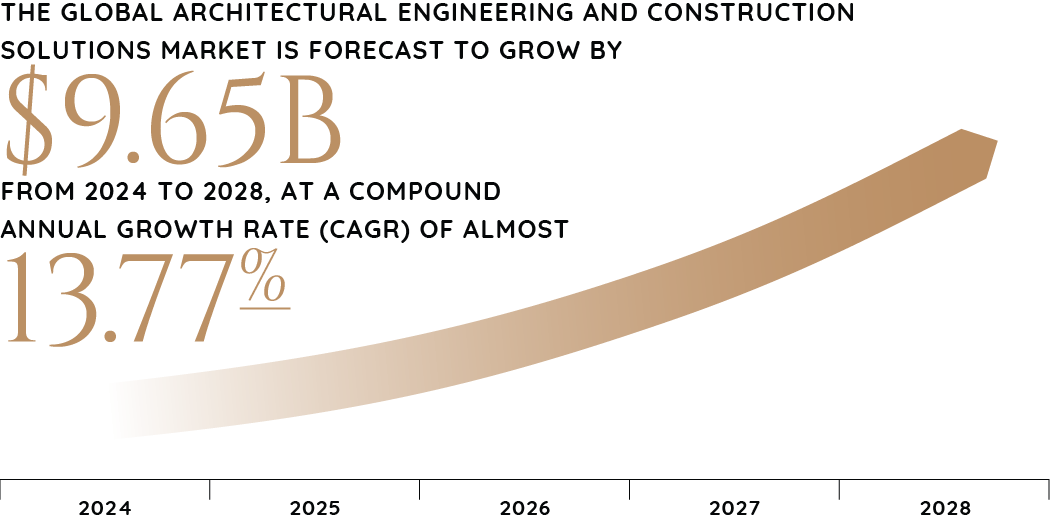

The global architectural engineering and construction solutions market is forecast to grow by $9.65 billion from 2024 to 2028 at a CAGR of almost 13.77%.

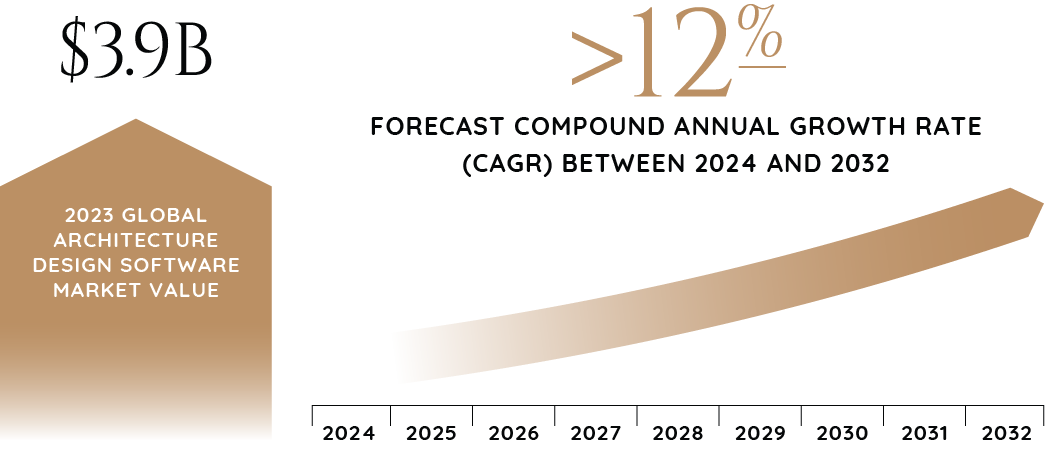

The architecture design software market was valued at $3.9 billion in 2023 and is predicted to register a CAGR of over 12% between 2024 and 2032.

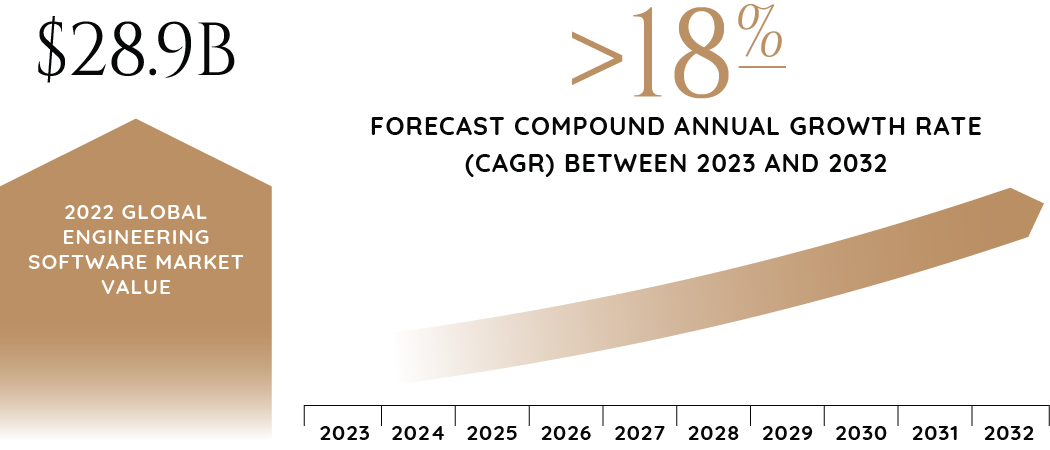

The engineering software market was valued at $28.9 billion in 2022 and is forecast to see a CAGR of more than 18% between 2023 and 2032.

The field of architecture is expected to grow by 5% by the year 2032, faster than the average for all occupations. Architects that specialize in sustainable design are on pace to be in higher demand.

KEY MARKET TRENDS

Technological advancements are overwhelmingly in the spotlight for the architecture & engineering sector in 2025, including significant opportunities for transformation through M&A for companies of all shapes and sizes. Among these, many in-demand innovations include:

- Digital twin technology, which creates a virtual replica of physical assets to allow for real-time monitoring, simulation, and optimization of buildings and infrastructure to boost efficiency, cut costs, and enhance decision-making

- Artificial intelligence (AI) and machine learning to analyze massive amounts of data to predict project outcomes, optimize designs, and identify potential risks.

- Emphasis on sustainable and resilient design for energy efficiency, environmental concerns, and protection from natural disasters

- Building information modeling (BIM) is becoming more advanced in generating digital representations of buildings and projects, which can improve upon material choices and schedules, models, conflicts, safety and sustainability, and budgeting.

- Modular and prefabricated construction to allow for faster, more cost-effective construction by fabricating building components off-site and assembling them on-site

- Robotics and automation to move materials, perform more precise welding more safely, design layouts, and work remotely in dangerous environments

- Drones for accurate surveying without surveyors physically on-site, efficient inspections, inventory management, progress tracking, and collecting real-time data

- Smart cities and infrastructure using the Internet of Things, such as sensors, data analytics, and AI, for more efficient and sustainable urban living conditions

- Blockchain technology for project management to offer a more secure, transparent, and immutable ledger of transactions, improving trust and collaboration among project stakeholders

- Upskilling existing talent to remain competitive amid labor shortages and skill gaps

- Human-centric design to prioritize the well-being of communities through improved accessibility, comfort, and health

- Adaptation to urban contexts via organic architectural design concepts, biophilic design for enhanced well-being, and seamless outdoor and indoor integration

- Regenerative buildings designed to reverse ecological damage and have a positive impact on the environment

- Large-scale 3D printing to open new possibilities in the construction of buildings and homes

Get Started on Your M&A Journey – Contact Us Now.

M&A

In 2025, companies in the architecture & engineering sector can expect to be focused on investing in technology in nearly every area of operations. Firms are going to need to seek out new ways to gather and analyze data to aid in better decision-making for projects, while also looking to create value and growth through strategies such as:

- Divestitures

- Cash flow optimization

- Capital allocation

- Increased private equity investments

Mergers and acquisitions are likely to remain an important growth strategy for both large and small architecture & engineering firms, with both vertical and horizontal integration on the table to:

- Improve supply chains and production and distribution channels

- Consolidate their market presence

- Keep up with technological innovations

- Diversify their offerings by targeted product lines

- Address labor shortages

- Adapt to shifting market dynamics

Participants in the market are likely to emerge as conditions stabilize regarding cooling inflation and interest rate cuts, as well as the fact that private investors are in a stronger position than ever to deploy capital.

Federal and other legislative funding is driving business performance into the foreseeable future. This supplemented demand has led industry constituents to pursue M&A strategies, both as buyers looking to improve their market position and sellers looking to capitalize on historic tailwinds.

Our Recent Success Stories in the Sector

Some of Benchmark International’s more recent successful deals in the architecture & engineering space include:

- The transaction between Concepts in Millwork, Inc., a family-owned, specialized subcontractor that designs, fabricates, delivers, and installs custom architectural millwork, and Quivion, a holding company founded by three owners with the goal of acquiring businesses in the Home Services Industry.

- The transaction between Structural Design Consulting Engineers Limited, a provider of consultancy services to architects, developers, and local authorities, and Wintech Façade Engineering Limited, which offers a range of specialist disciplines solely focused on the science of façade engineering.

- The transaction between D.R. Price Engineering & Land Surveying, Inc. and Boos Resource & Technology Group. D.R. Price is a multi-discipline engineering and surveying firm that provides a broad spectrum of structural engineering, civil engineering, mining engineering, land planning, land surveying, and construction surveying services. Boos Resource and Technology Group is an environmental and energy-focused solutions provider that delivers timely and cost-effective construction management, infrastructure, natural gas, and industrial services to clients across the United States and beyond.

Notably, Benchmark International was also awarded M&A Deal of the Year (100M-250M) for the acquisition of PBK Architects by DC Capital Partners at the 20th Annual M&A Advisor Awards.

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.